Working women life insurance and guaranteed pension planning in the Modern Tech World

Want to talk, call/ whatsapp at: 9480240513

In today’s dynamic and fast-paced, tech-driven environment, working women play an increasingly vital role in shaping the economic landscape. As they juggle career aspirations, family responsibilities, and personal growth, it’s essential for them to prioritize financial safety nets that ensure stability and security for themselves and their loved ones. Among the array of financial instruments available, life insurance and mutual funds emerge as powerful tools for working women to safeguard their futures, plan for retirement, support their families’ needs, and nurture their children’s educational aspirations while also providing assistance to aging parents.

Understanding the Modern Tech World:

The modern tech world offers unprecedented opportunities for women to thrive professionally. With advancements in technology and changing societal norms, women are breaking barriers and excelling in various fields, including STEM (Science, Technology, Engineering, and Mathematics), finance, healthcare, and entrepreneurship. However, along with the benefits come unique challenges, such as navigating workplace dynamics, managing work-life balance, and planning for long-term financial security.

The Importance of Financial Safety Nets:

For working women, financial stability is crucial not only for their own well-being but also for the security of their families. Life insurance and mutual funds serve as pillars of financial safety, offering protection against unforeseen circumstances and avenues for wealth creation and growth. By understanding the benefits and intricacies of these financial instruments, women can take proactive steps to secure their futures and achieve their long-term goals.

Life Insurance: Ensuring Financial Protection:

Life insurance provides a safety net for working women by offering financial protection to their families in the event of their untimely demise. It serves as a lifeline, ensuring that loved ones are taken care of financially, even when they are no longer around to provide support. With various types of life insurance policies available, including term life, whole life, and universal life, women can choose the option that best aligns with their needs and budget.

For working women in the modern tech world, term life insurance may be particularly attractive due to its affordability and flexibility. Term life policies offer coverage for a specific period, typically ranging from 10 to 30 years, providing financial security during the years when women are most actively building their careers and supporting their families. By paying a fixed premium, women can ensure that their loved ones receive a lump sum payout (the death benefit) if they pass away during the policy term, thereby safeguarding their families’ financial well-being.

Mutual Funds: Building Wealth for the Future:

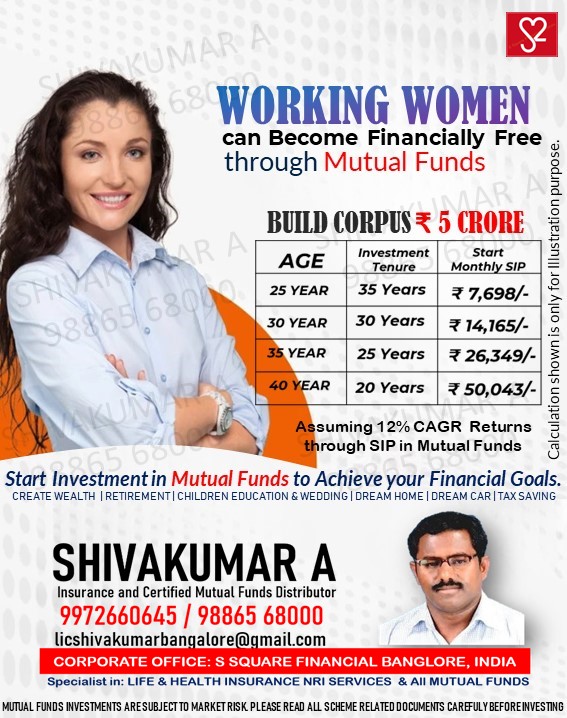

In addition to life insurance, mutual funds offer working women a powerful tool for building wealth and achieving their long-term financial goals. Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities, offering potential returns that outpace traditional savings accounts or fixed deposits. With a wide range of mutual fund options available, women can tailor their investment strategies to suit their risk tolerance, time horizon, and financial objectives.

For working women in the modern tech world, mutual funds can serve as a vehicle for wealth accumulation and growth, providing an opportunity to participate in the financial markets and benefit from the potential upside while diversifying risk. Through systematic investment plans (SIPs), women can invest a fixed amount regularly (e.g., monthly or quarterly) in mutual funds, leveraging the power of rupee-cost averaging to smooth out market fluctuations and build a substantial corpus over time.

Financial Planning for Retirement:

Retirement planning is a critical aspect of financial security for working women, particularly in the tech industry, where career trajectories may be nonlinear, and traditional pension plans are less common. Life insurance and mutual funds can play complementary roles in pension planning, helping women accumulate sufficient savings to maintain their desired lifestyle in retirement and achieve financial independence.

Life insurance retirement plans (ULIPs) offer working women a unique combination of life cover and investment opportunities, allowing them to build a corpus for retirement while ensuring that their families are protected in the event of their demise. By investing in ULIPs early in their careers, women can benefit from the power of compounding and potentially accumulate a significant retirement nest egg over time.

Family Needs: Balancing Responsibilities:

Working women often find themselves balancing multiple responsibilities, including providing for their families’ needs, supporting their children’s education, and caring for aging parents. Life insurance and mutual funds can help women navigate these challenges by providing financial support and security to their loved ones while also enabling them to pursue their personal and professional aspirations.

With adequate life insurance coverage, women can ensure that their families are protected financially in the event of their death, allowing them to meet ongoing expenses, such as mortgage payments, utility bills, and children’s education costs. Additionally, by investing in mutual funds, women can build a financial cushion to cover unforeseen expenses, such as medical emergencies or home repairs, while also earmarking funds for their children’s future education and other long-term goals.

Supporting Parents: A Generational Responsibility:

In addition to supporting their immediate families, working women often feel a sense of responsibility towards their aging parents, who may require financial assistance and care in their later years. Life insurance and mutual funds can help women fulfill this generational obligation by providing them with the means to support their parents’ needs while also planning for their own future security.

By investing in life insurance policies that offer cash value accumulation and living benefits, women can build a financial cushion to cover their parents’ medical expenses, long-term care costs, and other essential needs as they age. Similarly, mutual funds can serve as a source of supplemental income, allowing women to support their parents financially while also maintaining their own financial independence and well-being.

Conclusion: Empowering Women for Financial Success

In conclusion, life insurance and mutual funds are indispensable tools for working women in the modern tech world seeking to achieve financial security, retirement readiness, and family well-being. By understanding the benefits and intricacies of these financial instruments, women can take control of their financial futures, protect their loved ones, and navigate the complexities of modern life with confidence and resilience. With the right strategies and guidance, working women can empower themselves to achieve their goals, pursue their passions, and create a brighter and more prosperous future for themselves and their families