Mutual Fund investments and SIP

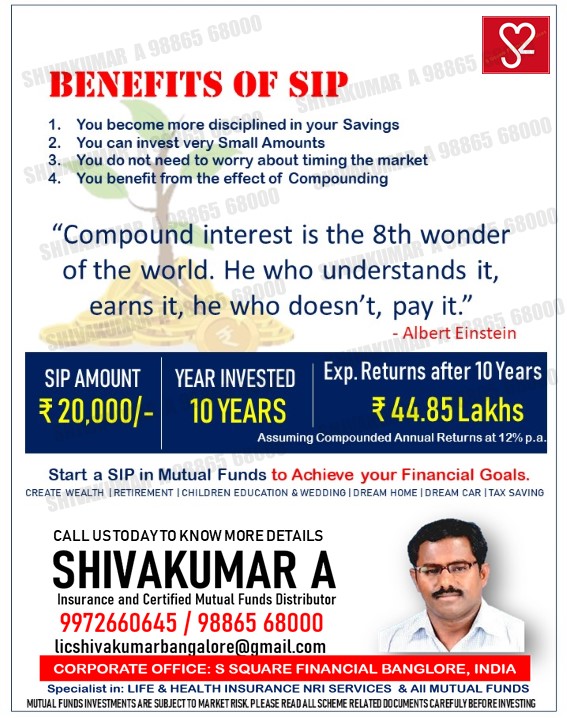

Investment in Mutual Funds* is considered to be risky, but without taking risks it is not possible to get good returns. The calculated risk would be a better choice than keeping the funds in the Fixed Deposit Account.

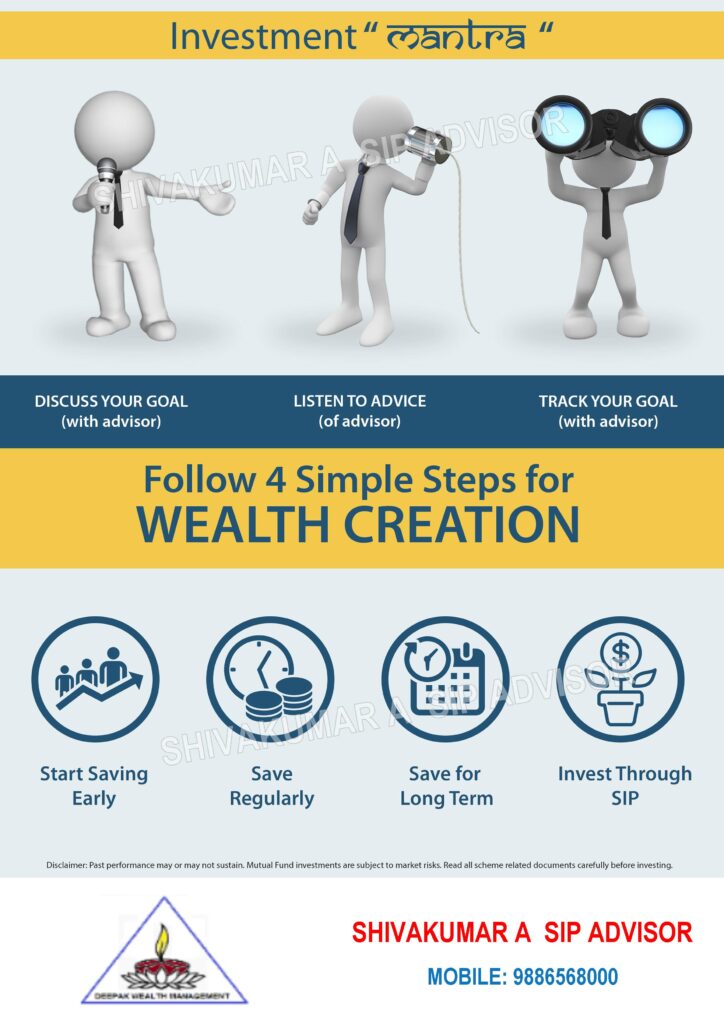

Mutual Fund investment can be done in two ways. SIP and lump-sum. SIP mode is considered to be the best as it averages every purchase and gives good returns. Lump-sum mode is considered for those who are ready to invest one time and leave it for a long time.

Step-up SIP is also considered the best way to beat inflation, as you should take advantage of the market fall and prop up your returns by making more investments or increasing your SIP.

There are many categories of Mutual Funds. The popular categories are Large Cap funds, Mid-Cap, Small-Cap and debt funds.

- Large Cap: Among all listed companies, the top 100 companies in terms of market value

- Mid-Cap: After the first 100 big companies in terms of valuation, 101st to 250th companies

- Small-Cap: After the first 250 big companies, 251st company onwards

There are many types of Mutual Funds. They are:

- Large-Cap Funds

- Mid-Cap Funds

- Small-Cap Funds

- Multi-Cap Funds

- Balanced Funds

- ELSS Funds

- Dividend Yield Funds

- Value Funds

- Contra Funds

- Focused Funds

- Sectoral Funds or Thematic

On the basis of a person’s risk appetite and goals, the selection of funds, and investment amount can be chosen. The Advantage of Mutual Funds, the investment can be started, stopped, decreased or increased at any time.

Mutual Fund investments calculator would be of great use to you, visit, the Mutual Funds Calculator

Mutual Fund Investments – Tax rules

If a fund is stopped and the investment is withdrawn within 1 year, then Short term Capital gain Tax would be 15% + CESS + surcharge. At the same time, if the redemption is done after one year from the date of investment, up to Rs. 1,00,000/- is tax-exempted. All profit withdrawal of more than Rs. 1,00,000/- would attract Long term capital gain tax of 10% + CESS + surcharge.

Equity Linked Savings Scheme (ELSS), which is a pure tax saving, cannot be withdrawn within 3 years from the investment date**.

The moral is, don’t let the market spook you into getting off your investment track. A SIP will work in all market cycles. It will work exceptionally well when the market sees a correction. There is only one scenario when a SIP won’t work, that is when you stop it.

For more info, call us or visit us: Webpage

*Investment in Mutual Funds SIP are subject to market returns, Please read the offer documents fully.

** From the date of investment and not the year starting the investment.