LIC Jeevan Labh

LIC Jeevan Labh policy is a limited premium paying, non-market- linked with profit plan. Jeevan Labh’s plan during death or maturity offers protection & benefit in the form of sum assured plus simple revisionary bonuses and final bonus, if any, payable to the nominee or policyholder. This plan gives the policyholder a kind of flexibility to pay the premium during his best earning years and get the best benefits at maturity.

Premium Payment Mode: Yearly, Half-yearly, Quarterly, Monthly(ECS)

Jeevan Labh policy term and premium paying term :

LIC Jeevan Labh policy offers a very flexible premium payment option.

There are three options that make this plan affordable to all ages.

1) 16 years term but pay for 10 years only

2) 21 years term but pay for 15 years only

3) 25 years term but pay for 16 years only.

The minimum age of entry is 8 Year Completed and the maximum age is 59 years.

Maximum Maturity Age: 75 Year

The minimum sum assured under Jeevan Labh is Rs.2,00,000/- and there is no upper limit for sum assured as well as premium payment.

Maximum Accidental Death and Disability Benefit Rider up to age 70.

LIC Jeevan Labh Policy Benefits :

On Death: Basic Sum-Assured, OR 10 times of Annualized Premium, OR

105%of all Premiums paid as on death, WHICHEVER IS HIGHER.

On Survival: On survival Basic Sum-Assured + Reversionary Bonus+ Final Additional Bonus.

Surrendered Value: The Policy can be surrendered at any time during the policy term provided at least three full years’ premiums have been paid.

Loan: Loan Facility is available under this plan, after payment of premiums, for at least 2 full years.

Income Tax Benefit :

• Premium paid under this plan is eligible for TAX rebate under section 80c.

• Maturity under this plan is free under sec 10(10D).

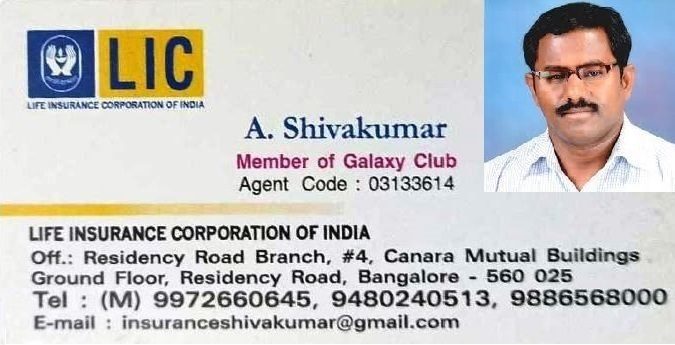

To buy LIC Jeevan Labh, Whatsapp or call us at 9886568000