Child Education planning takes a few seconds, a responsible decision for you and your family

Life is about experiencing every good bit of it throughout one’s lifetime; be it a walk in the park with your parents or building memories of playing with your little one. At Insurance Agent Health Insurance, we understand that these experiences can be truly rejoiced when one lives a healthy life without having to worry about any unforeseen medical issues.

Child Insurance Plans

Benefits of Child Plans

Effective child-rearing is no mean achievement. A colossal supporter of this achievement is monetary, getting ready for your kid’s future needs at the correct age! There is actually no better blessing you can give your kid, than the guarantee of a safe future with Youngster Child Plans that incorporate youngster protection plans and kid instruction plans from Insurance Agent Bangalore. This Birthday, present your kid a protected future and profession to watch her take off high to satisfy her fantasies with youngster speculation designs.

Waiver of Premium

A children’s insurance plan, like other life insurance policies, provides life insurance coverage to dependents. In this case, the protection is meant for the child.

Addressing Future Needs

A children’s future plan also provides money for higher education. In case of the untimely demise of the insured parent, many child plans have what is a called premium waiver feature that ensures that the child plan remains in force for the remaining part of the policy term.

Child’s Higher Education

A children’s plan works equally well if the unfortunate event doesn’t take place. You invest regularly throughout the term thanks to your premium payments.

Tax Benefits

This is the icing on the cake. Besides the protection benefits and helping you save substantial amounts, a children’s education plan helps you save taxes.

Features of Child Plans

Single Premium

Depends on the sum assured and the maturity amount. It can be a Regular premium: Yearly, half-yearly or even quarterly or single premium.

Sum Assured

Ideally, the sum assured should be around 10 times your present income.

Policy Term

Age at which you think your child needs to get on his feet – present age of the child.

Maturity Amount

Lump sum that you would require at the end of the policy term taking the inflation rate into account.

Premium Waiver

This rider can be added as per requirement in child plans. This rider enables the policy to continue by passing off the financial burden to pay the rest of the premium to the insurer, in case of death of the insured.

Partial Withdrawals

This feature helps to meet the financial needs of a child at key moments in his/her life.

Riders Benefit

Accidental Death and Disability Benefit, Critical Illness Rider Benefit etc.

Additional Covers

Additional benefits come with additional costs.

Documents Required To Buy Child Plans

- Age Proof -> Birth Certificate, 10th or 12th mark sheet, Driving License, Passport, Voter ID, etc.(Anyone)

- Identity Proof -> Driving License, Passport, Voter ID, PAN Card, Aadhaar Card, which proves one’s citizenship.

- Address Proof -> Electricity Bill, Telephone Bill, Ration Card, Driving License, and Passport, should clearly mention the permanent address(Anyone).

- Income Proof -> Income proof specifying the income of the person buying the insurance.

- Proposal Form -> Duly filled in proposal form is required.

- Medical Tests -> Some companies may require medical check-ups in order to make sure that the insured does not suffer from any chronic illness.

Concepts & FAQ’s Child Education Plans

What is the minimum installment amount for a Child Education Plan?

The minimum installment amount for the Child Education Plan is Rs. 500 and thereafter in multiples of Rs. 100.

When should I buy a child plan?

The ideal time to buy a child plan is when the child is still young and has not reached teens. This allows enough time to build the corpus you have planned for, with considerably lower premiums. If the child is already in their teens, you hardly get 3 to 5 years to build the same corpus, so the premiums are quite high.

What is a traditional child insurance policy?

The traditional child insurance policy has guaranteed returns. It has a fixed maturity amount that is given to the insured at a specific age. It can be of two types: i. Child endowment policy: In this case, the child receives a fixed maturity amount in a lump sum at the maturity of the plan.

What is a guaranteed addition?

Guaranteed addition is a percentage of the sum assured which the insurance companies guarantee. It is added to the basic sum assured or the maturity amount and is payable at the time of policy maturity.

Who can buy child life policies?

The child’s parent legal guardian or grandparent can buy the child life insurance.

Is the maturity amount tax-free?

Yes, the proceeds from a life insurance policy are tax-free on maturity.

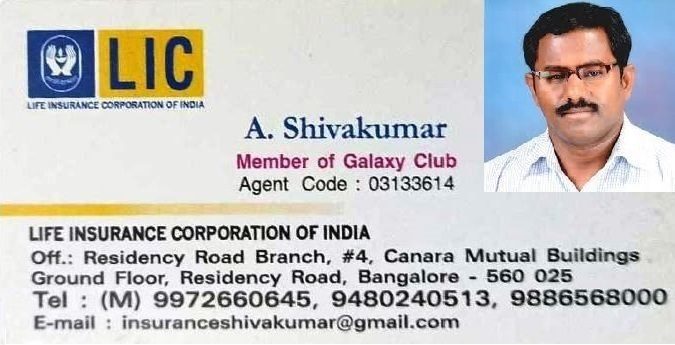

Contact us: WhatsApp/ call : 9886568000

All Insurance Company List

- Edelweiss Tokio Life Insurance Company Limited

- HDFC Life Insurance Co. Ltd

- Max Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Co. Ltd

- Kotak Mahindra Life Insurance Co. Ltd

- TATA AIA Life Insurance Co. Ltd.

- Aditya Birla SunLife Insurance Co. Ltd.

- SBI Life Insurance Co. Ltd.

- Exide Life Insurance Co. Ltd.

- Bajaj Allianz Life Insurance Co. Ltd.

- PNB MetLife India Insurance Co. Ltd,

- Reliance Nippon Life Insurance Company Limited,

- Aviva Life Insurance Company India Ltd.

- Sahara India Life Insurance Co. Ltd.

- Bharti AXA Life Insurance Company Ltd

- Future Generali India Life Insurance Company Ltd.

- IDBI Federal Life Insurance Company Limited

- Canara HSBC Oriental Bank of Commerce Life Insurance Company Limited,

- Aegon Life Insurance Company Limited,

- DHFL Pramerica Life Insurance Co. Ltd.

- Star Union Dai-Ichi Life Insurance Co. Ltd.

- IndiaFirst Life Insurance Company Ltd.

Disclaimer!

This is to inform you that insuranceagentbangalore.com does not charge any fees/security deposits/advances towards outsourcing any of its activities. All stakeholders are cautioned against any such fraud.