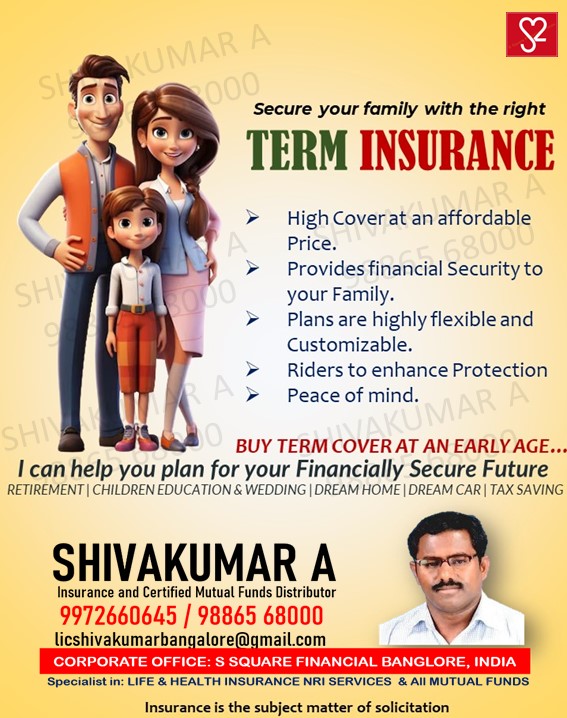

Term Insurance policy in India

The Essential Need for Pure Term Insurance Policies for IT Employees, HNIs, and Ultra HNIs

In today’s dynamic and uncertain world, financial security is paramount. For individuals belonging to the Information Technology (IT) sector, high-net-worth individuals (HNIs), and Ultra High Net Worth Individuals (Ultra HNIs), safeguarding their wealth and protecting their loved ones’ future is of utmost importance. Among the myriad of financial products available, pure term insurance policies stand out as indispensable tools for ensuring comprehensive protection. This article delves into the specific needs and benefits of pure term insurance for IT employees, HNIs, and Ultra HNIs.

Understanding Pure Term Insurance

Pure term insurance, also known as term life insurance, is a straightforward and cost-effective form of life insurance. Unlike traditional life insurance policies, pure term insurance provides coverage for a specified term, offering a lump sum payment (death benefit) to the policyholder’s beneficiaries in the event of the insured’s demise during the policy term. These policies do not include investment or savings components, making them purely focused on providing financial protection to the insured’s dependents.

The Imperative for IT Employees

High-Risk Professions

IT professionals often lead hectic lifestyles, working in high-pressure environments with demanding schedules. Additionally, frequent travel, exposure to technology-related hazards, and stress-related health issues are common occurrences in the IT industry. Given these factors, IT employees face heightened risks, making it imperative for them to secure their families’ financial future through pure-term insurance.

Financial Responsibility

As breadwinners of their families, IT employees bear the responsibility of ensuring their loved ones’ well-being. Pure term insurance policies offer an affordable means to provide substantial financial protection, ensuring that dependents can maintain their standard of living and pursue their goals even in the absence of the primary earner.

Tax Benefits

Pure term insurance premiums are eligible for tax deductions under Section 80C of the Income Tax Act, providing IT employees with an additional incentive to invest in these policies. By availing of tax benefits, IT professionals can optimize their tax planning strategies while securing their families’ financial future.

Catering to the Needs of HNIs

Wealth Preservation

HNIs, characterized by their substantial financial assets, have a vested interest in preserving and growing their wealth. Pure term insurance complements their existing investment portfolios by providing a crucial layer of risk management. By transferring the risk of financial loss to the insurance provider, HNIs can safeguard their accumulated wealth and protect their heirs from potential liabilities.

Estate Planning

HNIs often engage in intricate estate planning strategies to ensure seamless wealth transfer to future generations. Pure term insurance policies play a pivotal role in estate planning by providing liquidity to cover estate taxes, debts, and other financial obligations. This proactive approach enables HNIs to preserve their legacies and leave behind a lasting financial legacy for their heirs.

Customized Coverage Options

Pure term insurance policies offer flexibility in coverage amounts and policy terms, allowing HNIs to tailor their insurance plans to suit their specific needs. Whether it’s protecting business interests, providing for dependents, or planning for charitable giving, HNIs can design comprehensive insurance solutions that align with their long-term financial objectives.

Addressing the Requirements of Ultra HNIs

Exceptional Wealth Protection

Ultra HNIs, comprising the wealthiest individuals globally, require specialized financial solutions to address their unique risk profiles. Pure term insurance policies, with their substantial coverage amounts and simplified structure, offer ultra HNIs a reliable means to protect their immense wealth and provide for future generations.

Multigene rational Wealth Transfer

For ultra HNIs, preserving wealth across multiple generations is a top priority. Pure term insurance serves as a cornerstone of their wealth transfer strategies, ensuring a smooth transition of assets to heirs while mitigating potential estate tax liabilities. By incorporating insurance into their estate plans, ultra HNIs can foster intergenerational wealth continuity and legacy preservation.

Confidentiality and Privacy

Ultra HNIs value discretion and confidentiality when it comes to financial matters. Pure term insurance policies, with their non-disclosure of policy details and streamlined underwriting processes, offer ultra HNIs the privacy they desire. This confidentiality allows them to protect their financial affairs while maintaining control over their wealth management strategies.

Conclusion

In an era defined by uncertainty and complexity, pure-term insurance policies emerge as indispensable tools for securing the financial futures of IT employees, HNIs, and Ultra HNIs. By providing affordable and customizable coverage options, these policies offer peace of mind, ensuring that loved ones are protected against life’s uncertainties. Whether it’s providing for dependents, preserving wealth, or planning for future generations, pure term insurance serves as a foundation for comprehensive financial security and legacy preservation. Embracing the proactive approach of pure term insurance is not merely a prudent decision but a proactive step towards securing a legacy that transcends generations.