Buy new LIC policy and mutual funds in Bangalore

In the bustling metropolis of Bangalore, where the economy is as dynamic as its population, securing your financial future is a top priority for many. Life Insurance Corporation of India (LIC) offers a wide range of products that cater to diverse needs, from life insurance to mutual funds. Whether you’re considering a new policy for life insurance, looking into term plans, planning for your children’s education, seeking guaranteed pension solutions, or exploring mutual funds, LIC serves as a reliable option for those aiming to achieve financial stability and growth.

Life Insurance: Securing Your Family’s Future

Buying a life insurance policy is one of the most fundamental financial decisions you can make. In Bangalore, where the tech and business sectors are thriving, it’s crucial to ensure that your family remains financially secure in your absence. LIC’s life insurance policies offer a safety net, with benefits that often extend beyond mere financial aid after the policyholder’s demise, including loans against the policy and tax benefits.

Life insurance is not just about covering risks but also about planning for the future. It ensures that in the event of an unforeseen tragedy, your family’s financial needs, such as daily living expenses, outstanding debts, and future educational costs, are comprehensively covered.

Term Plans: Affordable Protection

For those looking for straightforward life coverage, LIC’s term plans in Bangalore provide substantial protection at affordable premiums. These plans are ideal for individuals in the early stage of their career or those with significant financial liabilities. In the event of the policyholder’s untimely death during the term of the policy, their beneficiaries receive the sum assured, which can provide significant financial relief.

Children’s Education: Planning Ahead

Education costs are soaring, and as a parent in a city like Bangalore, planning your child’s educational journey is crucial. LIC offers plans that are specifically designed to fund educational milestones. These policies not only cover life but also act as savings tools, providing lump sum amounts at critical junctures in your child’s educational path.

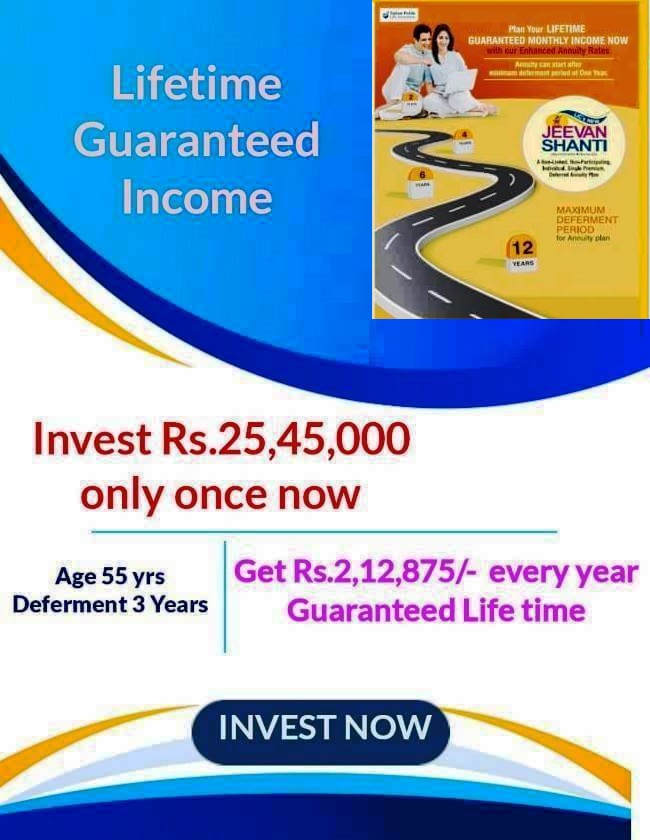

Guaranteed Pension: Ensuring a Comfortable Retirement

With the absence of traditional pension benefits in many modern careers, planning for retirement becomes essential. LIC’s pension plans are tailored to offer a stable income after retirement, ensuring that you can maintain your lifestyle without financial worries. By choosing a guaranteed pension plan from LIC, you are safeguarding your golden years against the unpredictability of life and market fluctuations.

Mutual Funds: Growing Your Wealth

For those looking to grow their wealth, LIC offers a range of mutual fund options. Investing in mutual funds through Systematic Investment Plans (SIPs) is an effective way to beat inflation and achieve financial growth over the long term. Unlike fixed deposits, which often struggle to outpace inflation, mutual funds offer the potential for higher returns, depending on market conditions.

LIC’s mutual funds are managed by professionals who allocate assets across various securities to diversify risk and optimize returns. For working professionals in Bangalore, who often do not have the time to analyze and manage individual investments, these mutual funds present a practical investment vehicle.

Why Choose LIC Over Banks?

While banks offer various financial services, including insurance and investment products, institutions like LIC specialize in these areas and provide tailored solutions with potentially higher benefits. The returns on traditional bank savings and fixed deposits are generally lower, especially when considering the long-term effects of inflation. On the other hand, LIC’s life insurance policies and mutual funds offer the dual benefits of security and growth, often surpassing bank interest rates.

Safety and Trust

As one of India’s oldest and most trusted insurance providers, LIC stands out with its legacy of stability and customer satisfaction. Choosing LIC for your insurance and investment needs means placing your trust in an institution that has served millions of Indians for decades.

Your Partner in Financial Planning

For those living and working in Bangalore, navigating the plethora of financial products can be daunting. LIC offers a trusted route, with its comprehensive range of products that cater to practically every major financial need, from the cradle to retirement. Whether it’s securing your family’s future with a life insurance policy, planning for your child’s education, ensuring a steady retirement income, or investing in mutual funds for wealth creation, LIC provides solutions that promise more than just bank-beating returns—they offer peace of mind.

Investing in LIC policies not only helps secure your financial future but also supports your aspirations for a better life. As you move forward in your career and personal life, consider LIC not just as an insurance provider but as a partner in your journey towards achieving long-lasting financial security and prosperity.

Considering the current international conditions, guaranteed monthly fixed income is a must.