LIC JEEVAN SHANTI PLAN – FIXED INCOME PLAN FROM LIC

Due to the coronavirus pandemic disease, there has been a contraction of the economy. Businessmen are apprehensive about the future and hence are not investing more money in business. They are also worried about future income. Hence, many are investing in LIC Jeevan Shanti policy to secure their future and get a steady, guaranteed income.

This plan can be purchased as QROPS, through the transfer of UK tax-relieved assets subject to listing and terms and conditions prescribed by HMRC (Her Majesty Revenue & Customs) such as:

i. The minimum age for annuity payment shall be 55 years of age (i.e. under Immediate annuity the minimum age at entry shall be 55 years and under Deferred annuity, the minimum vesting age shall be 55 years).

ii. If the policy is cancelled during the Free Look Period, the proceeds from cancellation shall only be transferred back to the fund house from where the money was received.

iii. Other terms and conditions of HMRC shall also apply as applicable from time to time. Indians abroad, are worried about the continuation of their employment abroad, hence they are investing in LIC Jeevan Shanti so that when they come back to India they have a steady source of income.

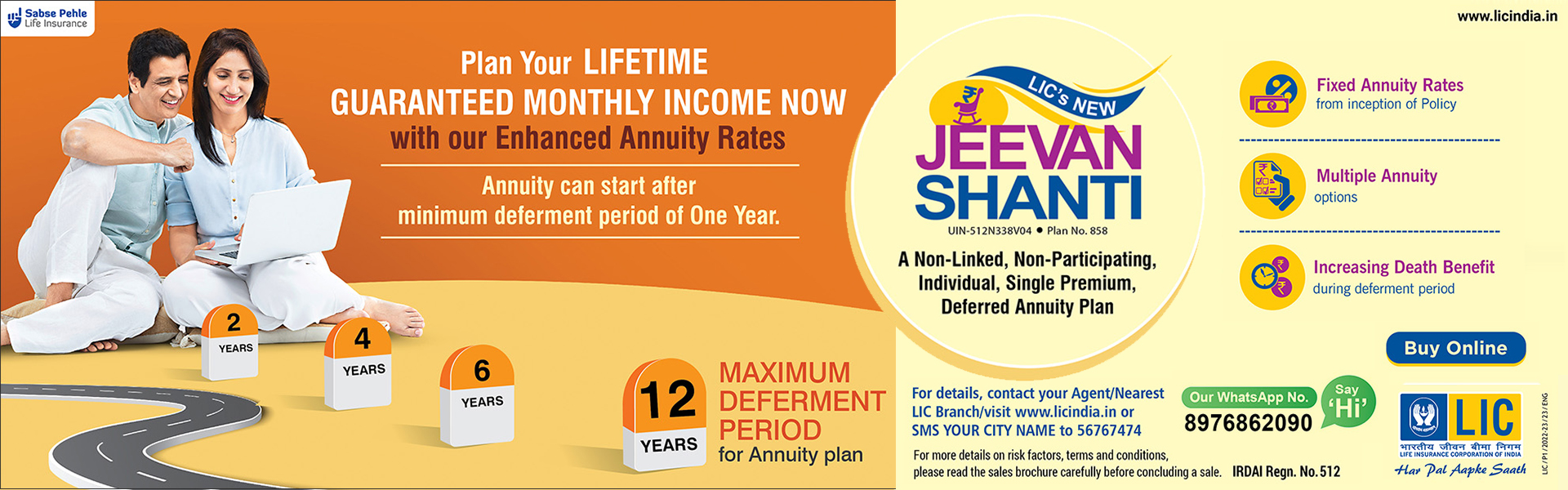

Many retirement funds are worried about falling interest rates and are investing in Shanti to get a steady, guaranteed income. There are no capital guarantees in most of the investments.

IT Sector professionals want to retire early. They are using the deferred option in LIC Jeevan Shanti to create a steady income flow after early retirement. There are two advantages of this plan, fixed income throughout the life and safety of the capital investment.

Natural calamities like drought, floods and earthquakes combined with the sluggishness in the real estate market are forcing people to invest in financial assets, and they are investing in Shanti to generate steady returns

Debt fund investors in mutual funds suffered huge value erosion recently due to defaults, and they are moving their monies to Shanti for safety and steady income

Volatility in the share market and valuations are unreasonably high and people are booking profits and moving the monies to the Shanti plan for the safety of the capital.

The demand for gold has gone down due to high prices and changes in the psyche of the younger generation. They prefer less ostentatious and inexpensive fancy ornaments. These monies are moving to LIC Shanti plan

Ostentatious weddings have stopped. Savings moving to Shanti

Middle and upper-middle-class people are choosing various deferment periods to get their desired returns and are investing small amounts of ₹10-₹15 lac. Many in Kerala by default chose 20 year deferment period to avail 18% annuity

Employers are investing in Shanti under the Employer-Employee scheme to earn the loyalty of employees as well as provide for their pension.

Parents with special children are using Shanti to create a steady income for their children using the concessions given in Shanti

A joint life option used by elders to provide for their spouses and their children and the investment benefits three generations

Jeevan Shanti can be assigned and hence many are using it to provide collateral for availing loans.

Trusts are investing big monies in the names of principal trustees and getting it assigned to the Trust to receive steady income

Rich people are using the Marriage Women Property Act, so that the capital and annuity belong to the Trust and the creditors can not attach it

- HUF are investing in Shanti to generate steady returns.

- Option for joint life ensures benefits for 3 generations.

- Liquidity by way of loans is a special feature of this pension product.

- 10 attractive options are available.

For more info on LIC Jeevan Shanti, call 9972660645

*As received in the WhatsApp message