Better investment than buying a flat and renting it out

Fixed income plan vs. Real Estate Investment

In the pursuit of securing a lifetime fixed income, individuals often contemplate various investment options, including insurance-based schemes like LIC Jeevan Shanti and LIC Jeevan Akshay, as well as traditional avenues like real estate. This article aims to provide insights into the pros and cons of each option, considering factors such as safety, reliability, and long-term financial stability.

Understanding the Options:

1. LIC Jeevan Shanti:

LIC Jeevan Shanti is a deferred annuity plan offered by the Life Insurance Corporation of India (LIC). It provides individuals with a guaranteed lifetime income in exchange for a lump-sum investment. The plan offers various annuity options, allowing policyholders to choose the most suitable payout structure based on their needs.

2. LIC Jeevan Akshay:

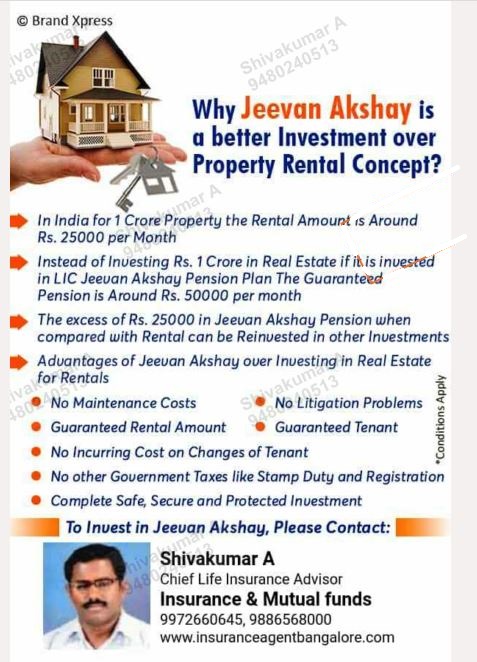

Similar to Jeevan Shanti, LIC Jeevan Akshay is also an annuity plan that provides a steady stream of income for life in exchange for a lump sum investment. It offers immediate annuity options with different payout modes, catering to the diverse requirements of investors.

3. Real Estate Investment:

Investing in real estate involves purchasing a property, such as a flat, and renting it out to tenants to generate rental income. While real estate can offer attractive returns, it comes with its own set of challenges and risks, including property management issues, legal disputes, and market fluctuations.

Comparing the options:

1. Safety and Reliability:

- LIC Jeevan Shanti and Jeevan Akshay: Both LIC annuity plans offer guaranteed income for life, providing a high level of safety and reliability. Policyholders can rest assured knowing that their investment will generate a steady stream of income regardless of market conditions.

- Real Estate Investment: While real estate has the potential for capital appreciation, it also carries inherent risks such as property depreciation, vacancy periods, and legal complications. Land litigation problems, rental disputes, and the uncertainty of finding reliable tenants can pose significant challenges.

2. Lifetime Fixed Income:

- LIC Jeevan Shanti and Jeevan Akshay: These annuity plans provide a fixed income for life, offering financial security and peace of mind during retirement years. The guaranteed payout ensures a stable source of income that is not dependent on market fluctuations or rental fluctuations.

- Real Estate Investment: While rental income from real estate can provide a steady cash flow, it is subject to market conditions and tenant behaviour. Landlords may face challenges such as rent collection issues, tenant turnover, and property maintenance costs, which can affect the stability of income.

3. Investment Flexibility:

- LIC Jeevan Shanti and Jeevan Akshay: Policyholders have the flexibility to choose from various annuity options based on their preferences and financial goals. Additionally, they can opt for joint-life annuities to provide financial security for their spouse or dependents.

- Real Estate Investment: While real estate offers the potential for capital appreciation, it requires a significant upfront investment and ongoing maintenance expenses. Moreover, liquidity can be an issue, as selling property may take time and involve transaction costs.

Conclusion:

Gone are the days of getting good rent, tenants taking care of the property, keeping it clean, paying taxes on time, and mainly attending the owner’s call. These days, the owner is working like a security guard and doing all the work related to the rented flat due to rental income. When considering options for securing a lifetime fixed income, individuals must weigh the pros and cons of LIC Jeevan Shanti, LIC Jeevan Akshay, and real estate investment. While LIC annuity plans offer safety, reliability, and guaranteed income for life, real estate investment entails risks such as property management issues, legal disputes, and market fluctuations.

The best advantage is that there is no problem with closing the policy in case of any eventuality for the policyholder. The property sale may not be easy in the event of an emergency.

Ultimately, the choice between LIC annuity plans and real estate investment depends on individual preferences, risk tolerance, and financial objectives. By carefully evaluating the factors discussed in this article, individuals can make informed decisions to ensure long-term financial stability and peace of mind.

Plan in a simple way, get tension free rental income every month directly to your account. Want more information, Call 9972660645.